Manage your super on the go

You can consolidate, check your contributions and investment options, and manage your super in our app.

Download the Cbus appMaybe you’re not planning your retirement just yet. But if you want to be free to do what you like when you retire, it pays to know how super works and how it adds up over time.

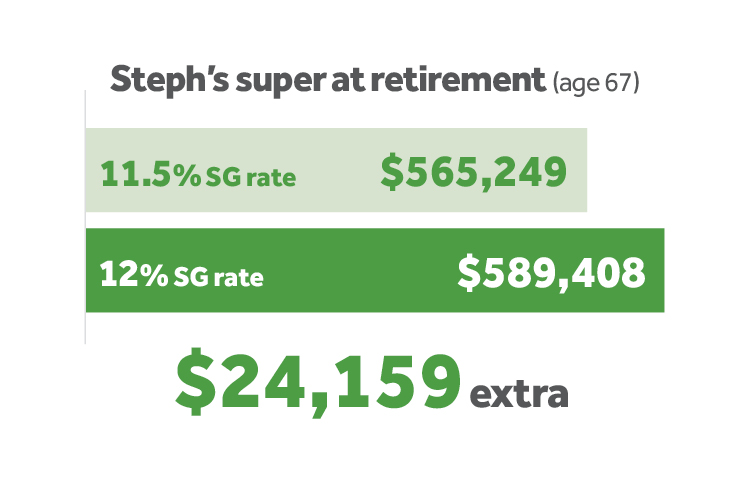

On 1 July 2025 the super guarantee (SG) went up to 12% (from 11.5%). This is the minimum that your employer must pay to your super if you’re eligible.

The government has been gradually increasing the SG to make sure Australians have enough money saved up for their retirement. Think of it as a forced savings plan for when you eventually stop working – that’s just got better!

For every $200 you earn, an extra $1 will be added to your super because of the SG increase. It doesn’t sound like much, but thanks to the power of compound interest, it really adds up over time.

Here’s what that $1 could look like in retirement1:

There are other ways to benefit from compound interest. And the earlier you act, the more growth you could see.

Having more than one super account can mean you’re paying more fees than you need to. There are things to consider, including your insurance, so head to our consolidation page to find out more.

Even a small amount now can help set you up for later, and you could potentially save on tax. Head to our contributions page to read about your options.

What’s right for you will depend on a few things. You’ll need to consider:

It’s important you understand your options and the impact of changing, so we recommend getting help from our Advice team.

You can consolidate, check your contributions and investment options, and manage your super in our app.

Download the Cbus app1 This is a projection for illustrative purposes assuming a 21-year-old worker with an $11,500 balance (starting balance based on average Cbus balance for members under age 25 as at 18/06/2025), earning $80,000 + 12% SG a year, works until age of 67 compared to the same worker receiving 11.5% SG a year. Returns in the projection are in today’s dollars and adjusted for inflation of 2.5% p.a. and a further 1.2% p.a. rise in living standards. We make a default insurance premium assumption that $214 will be charged and deducted in future years until retirement and will increase with inflation each year. Results are shown at 1 July upon reaching age 67. The results shown are estimates only and are not guaranteed and should not be relied upon as a true representation of any actual superannuation contributions, retirement benefit or taxation as tax and other rules can change. The 5.75% per annum investment return used in the calculation, is based on the Growth (MySuper) investment objective of CPI + 3.25% p.a., assuming CPI of 2.5% p.a. The return is after investment fees and taxes and excludes fees and costs that are deducted directly from members’ accounts. It is not a guaranteed rate of return. Current administration fees and costs of $52 per year, plus 0.19% of the account balance per year have also been assumed in the calculation. Figures are correct as at 18 June 2025.

Insurance is issued under a group policy with our insurer, TAL Life Limited ABN 70 050 109 450 AFSL 237848.

September 2025

Read the latest super, retirement and investment updates.

3 min read | Build your super

Find out what Vin and Amanda did, and why they’re loving the life they’ve built for themselves.

2 min read | Insurance

Four reasons why insurance is important, in your 20s, 30s, 40s and beyond.