Cbus MySuper dashboard

The Cbus superannuation product dashboard is set out to help you better understand the fees and costs, risks and performance for our default investment option, Growth (MySuper). You can use the dashboard to compare the Growth (MySuper) investment option with MySuper products offered by other funds.

The Growth (Cbus MySuper) investment option was launched on 1 October 2013 and was previously named Growth (Choice). The performance history includes the period before the MySuper launch. Effective 14 February 2022, the Growth (Cbus MySuper) investment option has been renamed to Growth (MySuper).

The information shown in the dashboard is based on a representative member with an assumed balance of $50,000. For more information on how to choose the right MySuper fund for you, go to the ASIC MoneySmart website.

Return

10-year average return of 7.48% per year as at 30 June 2025.

Level of investment risk

Medium to high

Negative returns expected in 3 to 4 out of every 20 years. Negative returns may occur more or less frequently than expected. The higher the expected return target, the more often you would expect a year of negative returns.

For more information, see our risk levels.

Return target

The return target for 2026-2034 is 3.50% per year above inflation, after fees and taxes. Future returns cannot be guaranteed. See the explanation below.

Statement of fees and costs

$462 per year

Fees and costs for a member with a $50,000 balance. Different account balances will have an effect on fees and costs.

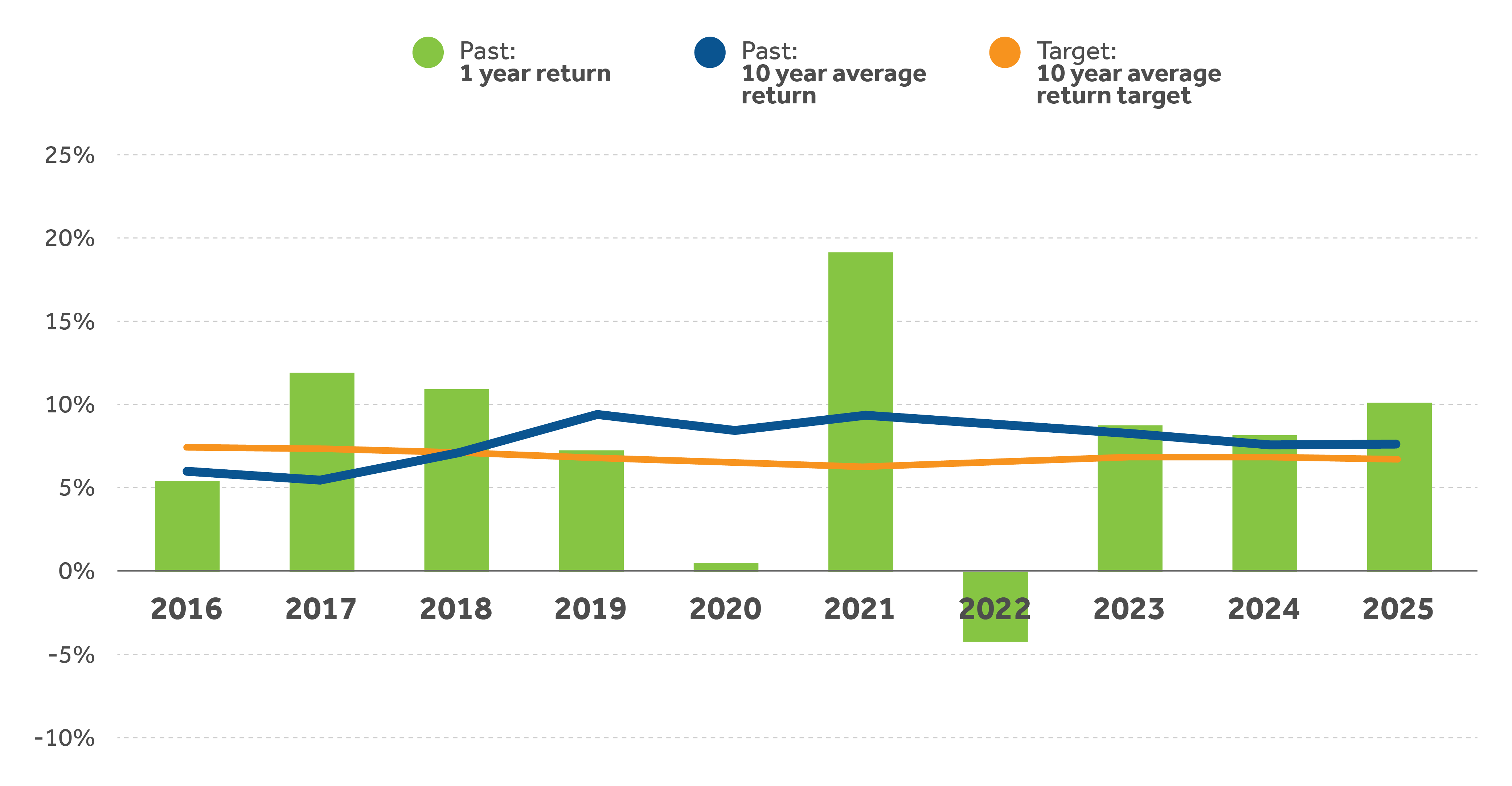

Comparison between return target and return

For financial years ending 30 June*

*Past performance is not necessarily an indication of future returns.

Dashboard explanation

Return

The return on prior years is the time-weighted rate of return on investments for the Growth (MySuper) option, minus investment, weekly administration and percentage-based administration fees, costs and taxes for a representative member. The figure is shown as an annual percentage earned over 1 year and as a rolling 10-year average.

This return calculation is different to the crediting rate used to allocate earnings to your account. The crediting rate is not reduced by the weekly administration fee, as this fee is deducted directly from your account. From 1 February 2020 the percentage-based administration fee will no longer be included in the crediting rate and will instead be deducted directly from your account.

Below are the figures for our 1-year returns net of fees and taxes:

| Year Ending | 1 year net return (%) |

|---|---|

| 30 June 2025 | 9.98 |

| 30 June 2024 | 8.00 |

| 30 June 2023 | 8.60 |

| 30 June 2022 | -4.17 |

| 30 June 2021 | 18.94 |

| 30 June 2020 | 0.49 |

| 30 June 2019 | 6.83 |

| 30 June 2018 | 10.79 |

| 30 June 2017 | 11.69 |

| 30 June 2016 | 5.31 |

Representative member

This is a member with a $50,000 balance at the end of each financial year.

Return target

The return target is the mean (average) estimate of return above the growth in the consumer price index (CPI). It is calculated as a 10-year annual average.

As this figure is based on the mean, we expect to meet or exceed the 10-year rolling return target roughly 50% of the time. Statistically, this means that roughly 50% of all rolling 10-year periods may have a return that is below the return target over the very long term.

Obtaining a return that is equal to the return target is not guaranteed. The return target is an estimate. We do not guarantee this will be reached.

The method to calculate a return target is prescribed by MySuper legislation, and is intended as a way to compare different MySuper funds. It is not the Growth (MySuper) option’s investment objective.

Consumer Price Index (CPI)

CPI is a measure of inflation reported by the Australian Bureau of Statistics.

Statement of fees and other costs

The statement of fees and costs includes the following fees and costs for the Growth (MySuper) investment option based on a member with an account balance of $50,000 throughout the year:

Administration fees and costs (which consists of the account keeping fee of $1.00 a week, plus the percentage-based administration fee of 0.19% per annum of your account balance capped at $1,000 per year, plus an estimated 0.07%* administration fees and costs a year deducted from fund reserves; and

Investment fees and costs** of 0.44%* and Transaction costs of 0.12%* a year, deducted from investment returns before they’re credited to member accounts.

* Investment fees and costs and transaction costs are deducted from investment returns before they're credited to member accounts and are calculated each year in arrears. The figures shown are estimates based on expenses for the period ending 30 Jun 2025. The calculation basis for these amounts is set out under the Additional explanation of fees and costs in the Fees and cost guide a cbussuper.com.au/fees.

** Investment fees and costs include an amount of 0.04% for performance fees based on the average performance fees for the five years to 30 June 2025. The calculation basis for this amount is set out under the Additional explanation of fees and costs in the Fees and costs guide at cbussuper.com.au/fees.

General advice warning

This information is about Cbus. It doesn’t take into account your specific needs, so you should look at your own financial position, objectives and requirements before making any financial decisions.

Past performance is not a reliable indicator of future performance.

To decide whether Cbus is right for you, read the relevant Target Market Determination and Cbus Product Disclosure Statement in forms and publications.

You can also request a copy by calling Cbus on 1300 361 784.