Our investment in Atmos Renewables

We’re committed to supporting Australia’s transition to a low-carbon economy through targeted investments in renewable energy infrastructure.

The December quarter saw a slowdown in the growth of global share prices, particularly in November and December. Investors become uneasy owing to delayed economic updates from the United States (US) Government shutdown and worries that technology and artificial intelligence stocks had become too expensive.

The US government shutdown meant investors got less information about key economic indicators, such as the unemployment rate and inflation. The figures that were available hinted that the US job market was still soft.

This heightened uncertainty contributed to increased volatility in both share and bond markets. It also led many economists to speculate that the Federal Reserve might lower interest rates in their December meeting.

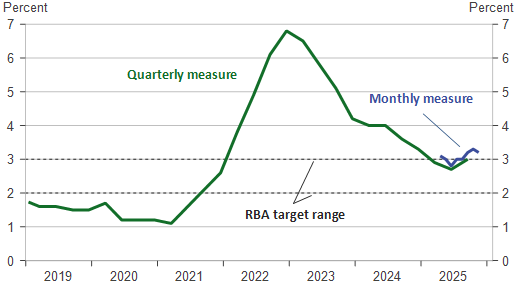

In Australia, the Reserve Bank (RBA) kept interest rates steady at 3.60% in November. Inflation data from the September quarter showed prices rising faster than hoped.

The new monthly inflation report showed core inflation at 3.3 percent in October, which is above the RBA’s target range of 2 to 3 percent. Because inflation remained high, markets shifted to anticipate a possible interest rate hike in 2026.

* Trimmed mean CPI inflation

Source: Australian Bureau of Statistics, Cbus Super, Macrobond

1 As at 31 December 2025. The crediting rate is based on investment returns minus investment fees and costs, transaction costs and investment-related taxes and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs that are deducted directly from members’ accounts. Past performance is not a reliable indicator of future performance.

View our latest TTR investment option performance.

Other major central banks, such as those in New Zealand and Europe, have hinted that their own cycles of interest rate cuts might be over. In the US, government spending is expected to rise in early 2026, possibly ending the Federal Reserve’s rate cuts as well. If the global economy remains steady, companies could continue their earnings growth. However, with both share prices and interest rates high and ongoing geopolitical risks, 2026 looks set to be another interesting year for financial markets.

We’re committed to supporting Australia’s transition to a low-carbon economy through targeted investments in renewable energy infrastructure.

The Strategic Asset Allocation (SAA) provides guidance for the portfolio allocation over the medium to long term (10+ years) and is reviewed annually. The SAA for all investment options can be found on the following pages:

The actual asset allocations at any point in time may differ from their respective targets due to market movements, cash flows and other activities.

Actual asset allocations are regularly monitored by the investment team and rebalanced back towards target, or in line with our views on opportunities and risks.

Figures are subject to rounding. Actual asset allocation is current as at 31 December 2025. Asset classes are the building blocks of our investment options. We allocate different proportions to each asset class with the aim of meeting each option’s investment risk and return objective. By investing across a range of asset types, the risk of a big fall in your account is reduced through diversification. For more information see asset classes.

We periodically review our investment strategy and believe that the Growth (MySuper) option is well positioned for growth over the medium to long term, while maintaining some defensive exposure. Cbus’ Pre-mixed investment options are broadly diversified across asset classes.

The information is about Cbus. It doesn’t take into account your specific needs, so you should look to your own financial position, objectives and requirements before making any financial decisions. Read the Cbus Product Disclosure Statement and the Target Market Determination to decide whether Cbus is right for you, or contact us for a copy.