Wayne Swan

Address to Australian workers union

Victorian delegates conference

7 October 2025

Moonee valley, Melbourne

INTRODUCTION

I’m delighted as always to be here as a proud and lifelong member of the Australian Workers Union.

As many of you may know, when I joined the union, I was a day labourer on a building site. An honourable profession. Then I became a politician . . .

Now, as a life member of this great union, I’m delighted to return to an honourable profession – maximising the returns of our union members’ superannuation investments.

And I can report up front that our returns remain strong.

We are a top-performing fund over 10, 15 and 20 yearsi.

Cbus Super’s Growth (MySuper) investment option has delivered a 10.29% return last financial yearii.

The High Growth investment option, which accounts for nearly ten percent of Cbus’ accumulation members and is skewed towards younger members, returned 11.80%iii.

Over forty-one years, Cbus Super's Growth (MySuper) option has an average annual return of 8.91% since its inception (as of June 30, 2025).

While it’s important to remember that past performance is not a reliable indicator of future performance, our overwhelming priority is to keep those returns high while making the fund secure well into the distant future.

But we should never forget how this all came about. Unions went on strike for it. And they won.

11 dollars a week. 9 dollars for super, a dollar for administration and a dollar for insurance.

Many older workers lost more on strike than they could ever hope to receive through super—but they did it anyway.

Because they knew that they were creating something bigger.

Without their fight and sacrifice, there would have been no superannuation guarantee in 1992.

No compulsion, no universality and most likely no preservation.

From 11 dollars a week to a system worth $4.1 trillion.

So, we have a profound duty to honour that sacrifice and protect this for our fund members – because it gives them a better retirement.

But it’s a duty to the country as well. The importance of super is far wider than we commonly think. Because it gives people a stake in the country, a stake in its future, and a reason to support the things that make our country one of the best in the world.

PROMOTING ECONOMIC FAIRNESS TO PROTECT DEMOCRACY

One of the many tasks of this job is to keep a broad perspective on how the world is faring.

I must maintain an eagle eye on what happens in the national and international political economy because it has a very direct impact on what happens to our members’ retirement savings. Recently, I travelled to the UK and met social democratic leaders from Britain, Canada, and Scandinavia.

We certainly live in interesting times.

If some of our parents, grandparents and great-grandparents were to reappear tomorrow morning and read the newspapers, they might think little had changed from when they were young – when authoritarians were in power and the world was sliding into division and conflict.

My own dad would probably have that reaction, having spent some of his youth fighting for his country. My grandad too, who suffered terribly on the Western Front during the First World War and died young from the injuries he suffered.

I’m guessing many of your past relatives did similar things. We must do everything we can to avoid it all happening again.

Concern about the spread of extremism is very, very real.

Here in Australia we are holding our democracy and our national consensus together.

In fact, I say proudly as an Australian, the Brits are slightly in awe of us. (Something we hope will last during the Ashes this Summer.) Our prime minister got a rousing ovation in the UK last week.

I don’t think Australia has ever stood higher on the world stage than now.

Yes, we have our share of extremists. . . But our economy and society and political system stand strong.

Why is this?

Britain and much of Europe have endured a decade and a half of flat economic growth, austerity and widening inequality. But we have achieved strong economic growth, that has been spread far more equally than elsewhere.

In most countries the gap between the top ten per cent and the bottom ten per cent of incomes had been widening.

In Australia it has been narrowing. We are all better off, not just the top earnersiv.

Abroad, support for people peddling grievance politics springs from a simple fact. Many working people have been left behind.

Here we have avoided it. And the reason is pretty simple. Our economy is delivering for the majority.

Inflation is down.

Three years ago it was 7.8 per cent. Today it’s back within the 2 to 3 per cent band targeted by the Reserve Bank.

Unemployment is low.

Currently it’s around 4 per cent and participation in the job market is high. Unemployment has crept up slightly, but it is well below what it was before Covid. A million jobs have been created since May 2022.

We have never – and I mean never – seen a bigger fall in inflation with such a small effect on unemployment.

Australia has done what many economists said couldn’t be done: we have broken the back of inflation without scorching the livelihoods of working people. That’s a profound achievement.

And we know that our proud AWU member Jim Chalmers will do his best to get that unemployment figure low.

All this, while our economy continues expanding.

I want to show you just four graphs today because they are linked and demonstrate important truths that concern us as unionists and superannuation account holders.

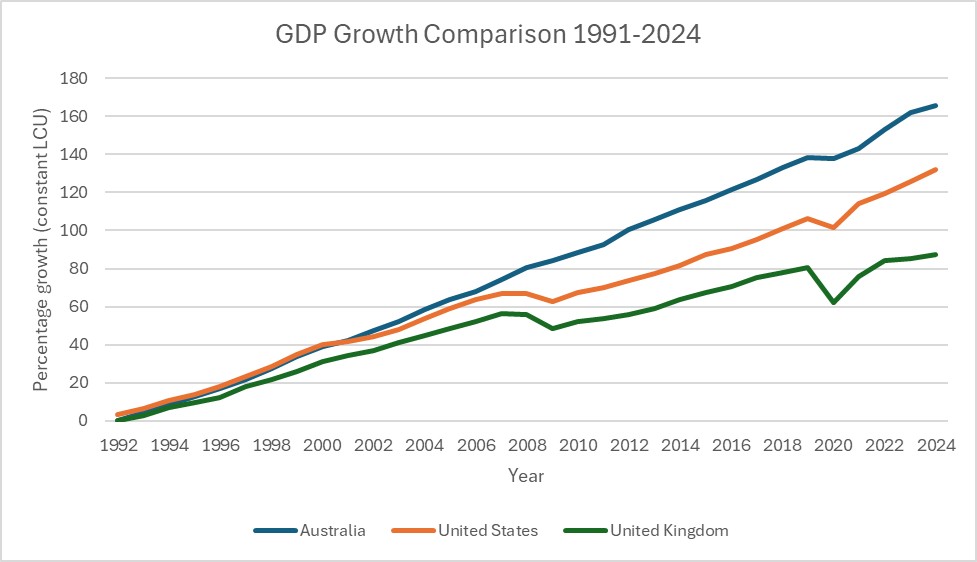

This first one shows how we have fared against US and UK economic growth since 1991.

Since 1991, the UK economy has grown by 87 per cent. The US economy by 132 per cent. And the Australian economy by 165 per cent. That blue line at the top is us.

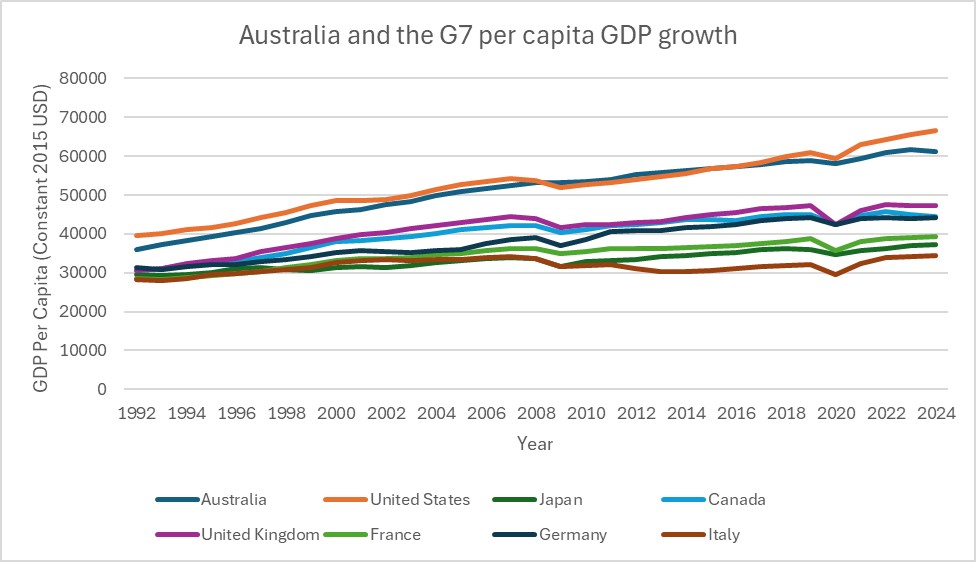

And this second graph shows how we have performed against some of the world’s richest nations, the G7, over the same period.

We are the second line from the top, shadowing and at times overtaking the United States. Where other nations have had faltering growth, our GDP per capita has close to doubled in real terms.

Our performance from 1991, through the Global Financial Crisis, and beyond Covid pandemic, was on the whole, outstanding. It included the longest uninterrupted upswing in our history, and the longest in the developed world over that period.

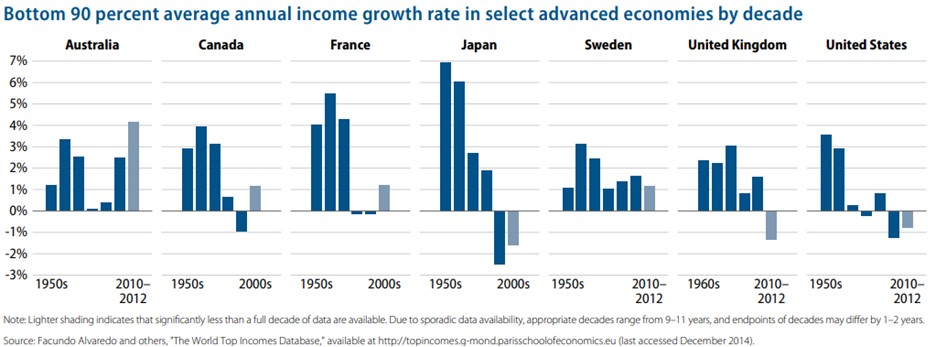

And importantly, the growth has been more fairly shared in Australia than in other developed countries over a very long period of time.

As this graph shows income growth for the bottom 90% for many advanced economies has stalled, historically this has not been the case for Australia.

So while the global economy is volatile at present we have a right to be optimistic about the economic outlook here in Australia.

While we have a productivity challenge, but business investment in Australia is strong, it has increased faster than GDP as a whole and on the most recent numbers business investment is up one fifth compared to where it was just before COVID hit us.

And importantly, the federal governments Future Made in Australia policy is providing critical support to key industries that are building up our sovereign manufacturing capability.

SUPERANNUATION HELPS EXPLAIN OUR EQUALITY AND ECONOMIC SUCCESS

A big part of our success in creating a bigger economic pie and sharing it fairly is our system of compulsory superannuation. Much of the wealth that has been created has accrued to funds like Cbus, to benefit people like you.

As if it needs repeating, our industry funds exist for one reason, and one reason only. To give people in this room a better retirement. The member is the only master.

These pooled retirement savings are a national secret weapon, enabling us to rebuild, retool and modernise our nation. By investing to maximise member returns, we lift national productivity and expand Australia’s future wealth.

Let me give you concrete examples. Cbus holds stakes in 29 of Australia's 30 largest manufacturers—companies generating $64 billion in revenue and employing 48,000 Australians. Ten of these are Victorian companies alone, creating $30 billion in revenue and 17,000 jobs.

Nationally the sums invested in super are impressive. Staggering almost.

No less than $4.1 trillion from an economy with a nominal GDP of $2.2 trillion.

And that capital is working. We're major investors in CSL, Bluescope Steel, and emerging manufacturers like Viva Energy and Orora. Eight of our top 25 holdings are manufacturers—your retirement savings are backing the companies building Australia's industrial future.

Take Bluescope Steel. Already the largest private employer on the Mornington Peninsula, they're now investing $300 million to modernize their Port Kembla operations and building new facilities in Western Sydney.

Or Orora in Dandenong—expanding their aluminium can manufacturing with Victorian government support. These investments on mean cranes on building sites, workers getting hired, and Australian industrial capacity getting stronger. And your super is making it happen.

Our pension system is 3rd in the OECD by size, despite Australia being 14th in the OECD on population.

In fact, if our super system was a country it would be the 8th largest economy, above Italy and just below France.

What an asset! We must keep it strong.

And we must keep it working for the benefit of the millions of members of those funds by maintaining the uniquely democratic features of industry funds.

And delegates we have a second secret weapon. It’s our egalitarian, co-operative philosophy. And the Australian Workers Union has been pivotal to making this a defining national value.

So much so, it is embedded in the structure of our superannuation system – run jointly by employers and unions, based on the principle of all benefits accruing to members and only to members.

No profits go to shareholders, including banks. There is no deep gouging by the advice industry, no multiple ticket clipping by insiders. All returns flow to the fund and ultimately to you.

It has meant higher average returns than those delivered by the commercial funds.

For example, the average retail fund has delivered nearly $23,000 less to their members than the average Industry SuperFund over the last 15 yearsvi.

All adding up to a more secure and comfortable retirement for members who have worked their guts out in some of the most physically demanding and dangerous occupations there are.

Importantly, it has also contributed to more democratic control of capital and more even spread of wealth than in most places on earth.

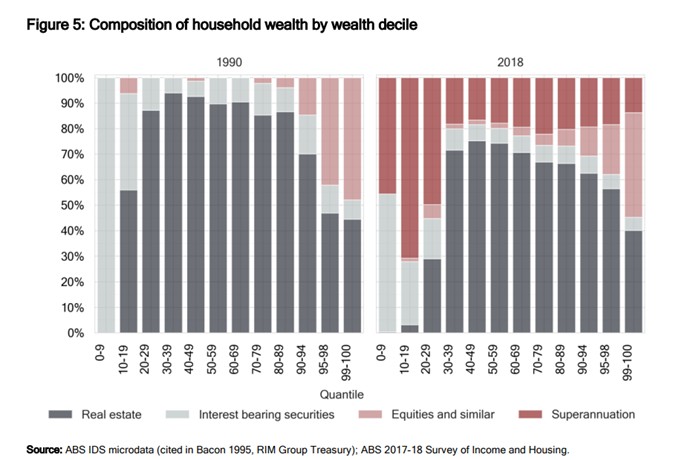

My fourth graph – I promise this is the last one – illustrates this point like nothing else

This shows who owned the capital of our nation before and after the introduction of the Superannuation Guarantee in 1992

On the left, before the Superannuation Guarantee, the wealthiest top 10 percent of Australians owned almost all the shares and gained almost all the income from them. And the top one per cent owned much of that. The lowest earning 30 per cent owned nothing but their house and their bank account, with the lowest 10 per cent not even owning a house. They retired on the pension.

But on the right, after the introduction of the Superannuation Guarantee, the lowest 30 per cent of income earners own a good proportion of the nation’s capital collectively through their super accounts. Economic growth now flows to workers, not just inheritors of family wealth. People in the bottom and the middle, not just those at the top.

That really is something for all of us to be proud of.

It means members of Cbus and every other super fund have a stake in Australia’s national economic success. Their lives are less precarious than before. It’s the greatest antidote there is against political extremism and instability.

It’s good for their personal prosperity, for our economy, for our society and for our democracy.

SUPER MAKES FOR A MORE OPTIMISTIC SOCIETY

In the past, after four decades on a building site, the pension was hardly something to look forward to.

Now, even a modest super balance can ease the financial pressure and could mean a tinnie or a caravan or holiday with the grandkids.

We interviewed a lot of fund members recently to ask them about what super meant and got some interesting replies.

Barry, who is retiring soon, told us he and his wife have some big plans. “I’ve got a decent whack of super, and it should be enough for the family and me to do some stuff with. I reckon I’m a bit lucky – it wasn’t like that for my dad and his mates; all they had to rely on was the pension.”

Yes, exactly. Barry got it in one.

Barry has been with the fund for about 40 years, so he’s one of the first generation to get full benefit from the scheme.

Now, with a lifetime of even higher contributions ahead of them, younger workers, like another we spoke to – Taylor, a 21-year-old building worker – told us he has started to realise that super is for the long term and it’s a smart way to invest and he’s going to stick with Cbus. He won’t regret it. That compounding interest will set him and his girlfriend up for life.

Now is a good time to renew our efforts

We have a responsibility to protect, extend and improve this wonderful superannuation system.

Now is a good time to renew our efforts.

The regulators are upping their compliance demands, and rightly so. We are happy to be examined and ensure our fund is run as strongly as possible.

Strong questions are being asked of all funds. Over the last year or so the entire super system has faced tough criticisms from the regulators.

It's actually been good for us and we’re better for it.

And we are as glad as anyone that the entire super system is strongly and diligently regulated in the national interest.

The whole industry now faces a similar challenge as it matures.

Like others, Cbus has reached an important moment in our history as a fund.

I mentioned our 40-year member “Barry” just now – who is moving from his personal accumulation to his pension phase. Having invested hard, it’s time for Barry to spend.

At around 40 years of age, the industry super system is also collectively moving from saving to spending. Having invested hard for 4 decades, it’s time for us to help our members spend their money in the best possible ways to improve their lives.

The industry has also gotten massively bigger, which has understandably brought with it a lot more complexity and compliance.

And this is requiring a certain amount of readjustment from the entire industry.

It’s a challenge. But we are up for it.

BUT WE WILL DEFEND THE INDUSTRY SUPER MODEL

One thing we won’t change is our support for the foundational ideas of industry superannuation: strong member representation on boards alongside employers; low fees; a strong presence in the workplace; products suited to the particular needs of building industry workers; and an emphasis on profits for members only.

No matter what the critics say, industry funds continue to outperform the other funds. By a long way. And I’m certain it will stay that way.

CONCLUSION

I want to finish by saying this: what all of us do in the service of our members has real meaning in the wider world.

Whether it’s people like you directly bargaining for higher wages and better conditions . . . Or people like me, fighting to maximise returns for industry fund members . . . We’re doing more than just our day jobs.

We’re ensuring our economy delivers for everyone. And this is more than just rhetoric. Late last month, we were one of only nine nations to be rated triple A by all three ratings agencies when S&P reaffirmed our good standing.

Good economics twinned with strong social policy is absolutely imperative. History shows that in the absence of a fair go for working people, trouble follows.

And not just history. We can see it happening before our eyes right now.

It’s my belief that by doing what we are doing, we are not just ensuring Australia comes through these dangerous times in good shape, but that we can set an example for other nations about how to succeed.

They’re definitely listening.

Let’s keep the faith and keep working hard at what we are doing – creating a better life for working people and keeping democracy strong.

i ‡ Taken from the SuperRatings FCRS SR50 Balanced (60-76) Index (August 2025). Our Growth (MySuper) investment option obtained a top quartile performance ranking over 10, 15 and 20 years for the period ending 31 August 2025. SuperRatings is a rating agency that collects information from super funds to enable performance comparisons - visit www.superratings.com.au for details of its rating criteria. Past performance is not a reliable indicator of future performance.

ii As at 30 June 2025. The Growth (MySuper) is the default investment option for accumulation members. The crediting rate is based on returns minus investment fees and costs, transaction costs and investment-related taxes and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs that are deducted directly from members’ accounts. Past performance is not a reliable indicator of future performance.

iii † As at 30 June 2025. The crediting rate is based on returns minus investment fees and costs, transaction costs and investment-related taxes and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs that are deducted directly from members’ accounts. Past performance is not a reliable indicator of future performance. 9.3% of members as at 7 October 2025.

iv Looking at income after tax and after government payments over the decade to 2020, the Parliamentary Research Service concludes: Income growth over the decade in real terms (in 2019-20 dollars) was strongest for bottom 10% of the household distribution, up 13.9%, albeit from a relatively low base, and weakest for those in the top 10% of the household distribution, up 7.7%.

v Centre for American Progress Inclusive Prosperity Report www.americanprogress.org/article/report-of-the-commission-on-inclusive-prosperity/

vi Industry Super Australia, comparisons modelled by SuperRatings, commissioned by ISA, and shows average differences in net benefit of the 'main Balanced option' of 7 Industry SuperFunds and retail funds tracked by SuperRatings, over a 5, 10 and 15 year period . A 'main Balanced option' being the fund's largest Balanced option where 60% to 76% of the fund's assets are invested in growth investments. This is generally the fund's default option. Where a fund does not have a Balanced option, the option closest to SuperRatings’ benchmark range of 60% to 76% growth investments is used. Outcomes vary between individual funds. Modelling performed on 14 October 2024 using data as at 30 June 2024. See www.industrysuper.com/assumptions for more details about modelling calculations and assumptions.

This information is about Cbus Super. It doesn’t account for your specific needs. Please consider your financial position, objectives and requirements before making financial decisions. Read the relevant Product Disclosure Statement (PDS) and Target Market Determination to decide if Cbus Super is right for you. Call 1300 361 784 or visit cbussuper.com.au.

Insurance is issued under a group policy with our insurer, TAL Life Limited ABN 70 050 109 450, AFSL 237848.

Cbus Super is the leading Industry Super Fund representing those that help build, maintain and shape Australia. As one of Australia’s largest super funds, we provide superannuation and income stream accounts to more than 900,000 members and we manage more than $105 billion of our members’ money (as at 30 June 2025). As of April 2022, Cbus merged with Media Super and offers Media Super products. In May 2023 Cbus Super successfully completed its merger with EISS Super, welcoming 17,000 new members and establishing itself as the leading fund for energy and electrical workers in Australia.

Issued 9 October 2025, United Super Pty Ltd ABN 46 006 261 623 AFSL 233792 as trustee for Construction and Building Unions Superannuation Fund (Cbus and/or Cbus Super) ABN 75 493 363 262.