Fund performance

Our Growth (MySuper) investment option returned -0.37%* for the March quarter, taking our current financial year to date return to 5.17%*. And over the last 10 years we have delivered an average annual return of 7.18%*, making us one of the top performing super funds over the long term**.

Market update

Investment options, like our Growth (MySuper) investment option, are invested in share markets both in Australia and overseas. Share price movements both up and down can be unpredictable, especially in the short term.

Recent volatility in share markets can be largely attributed to Donald Trump’s policy agenda. Since taking office, President Trump has been busy making significant policy announcements, some of which have taken investment markets by surprise.

One of the biggest surprises was the introduction of a 25% tariff on any imports into the US from Canada and Mexico that are not covered under the region’s USMCA trade pact. Both Canada and Mexico have subsequently announced their own tariffs on the US.

Not only have we seen larger than average movements in share prices on a day-to-day basis in response to these announcements, but it has also led to a reassessment of many countries’ economic growth expectations. This has subsequently seen a reversal in the prices of some of last year’s stronger performing investment trades, especially in shares and particularly the “magnificent seven” which are large, US based technology companies, which have fallen in value by around 16.5% (in Australian dollars) over the first quarter of the year. However, it is important to bear in mind that these same stocks rose an impressive 96.7% (around 40% p.a. in Australian dollars) over the two years to 31 December 2024.

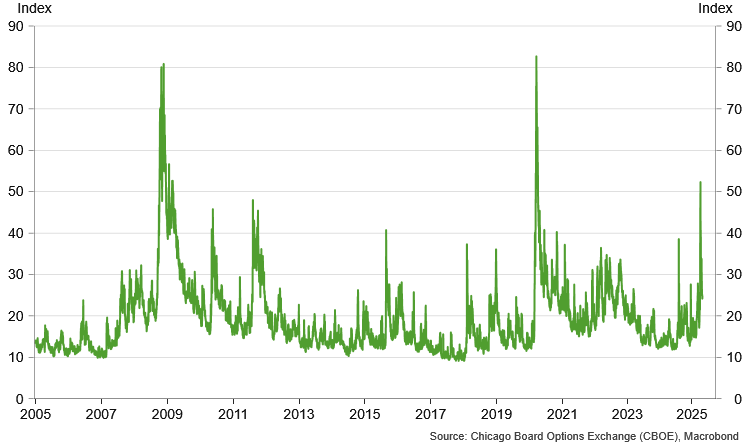

VIX Volatility Index

Implied volatility of the S&P 500, daily.

* Investment performance is based on the crediting rate, which is the return minus investment fees, taxes, and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs that are deducted directly from members’ accounts. Past performance is not a reliable indicator of future performance.

** The Growth (MySuper) investment option obtained top quartile performance ranking over 10, 15 and 20 years from the SuperRatings FCRS SR50 Balanced (60-76) Index, for the period ending 31 March 2025. Past performance is not a reliable indicator of future performance. SuperRatings is a rating agency that collects information from super funds to enable performance comparisons – visit superratings.com.au for details of its rating criteria.

Performance update

Transition to retirement investment options

View our latest TTR investment option performance.

Outlook

We understand that market ups and downs can be unsettling, but it is important to remember that super is a long-term investment. Our portfolios well diversified and designed to withstand periods of investment market volatility. Furthermore, markets can recover quickly if the changes don't accurately reflect the economic outlook. This is why it’s important to remain invested with the long term in mind.

Investment spotlight – Investing in renewables and the energy transition

As one of Australia’s leading super funds for those that help to build, maintain and shape Australia, we invest in projects and businesses that are in our members’ best financial interests, are important to our members and will make a difference in the real world.

Investing in renewable technologies and energy transmission and distribution assets is one way we can play an integral role in helping Australia meet its net zero emission targets, while also generating investment returns for our members

This is why we are continuing to work with our partners and governments at federal, state and local levels both on the funding and policy models that will attract greater investment into the energy transition.

Some direct and impactful ways we can invest in renewables and the energy transition include; wind, solar, hydro, transmission, distribution and storage.

How do we invest in renewables today?

Even though renewable technologies such as wind and solar have been around for quite some time, they are still regarded as relatively new assets to invest in. Traditional infrastructure assets such as airports and toll roads have been accessible to large investors like Cbus for decades.

Despite this, we’ve invested in more than $1.1 billion* in wind, solar, storage and other renewable energy opportunities in Australia and overseas and we have around $1.1 billion* invested in energy transmission and distribution assets locally.

Diversifying our renewable investment exposure

Whilst renewable generation and storage technology is quite mature, the location, roll-out and inter-play between traditional generation and renewables is still evolving at a relatively fast pace. Governments around the world will play a critical role in ensuring that legislation and policy settings continue to support the roll out of renewable infrastructure.

This is why we also believe it is important to diversify our portfolio exposure to the energy transition. The main ways are:

- Across a range of renewable technologies, including wind, solar, hydro and storage.

- Across different geographies such as Australia, North America and Europe.

- Across energy distribution and transmission assets, which have different value drivers to renewable generation.

We believe our approach ensures we are not relying on just one type of renewable technology to generate investment returns for our members. It also protects us from changes in government funding or policy settings from one country to another, which can vary over time as different governments attempt to fine tune their approach to the energy transition.

With a significant amount of global investment activity expected in the coming years, in areas such as wind, solar, battery storage and long-duration storage, this should also create more opportunities for investors like us to further diversify our exposure to renewables.

* As at 30 September 2024

Asset allocation

The Strategic Asset Allocation (SAA) provides guidance for the portfolio allocation over the medium to long term (10+ years) and is reviewed annually. The SAA for all investment options can be found on the following pages:

The actual asset allocations at any point in time may differ from their respective targets due to market movements, cash flows and other activities.

Actual asset allocations are regularly monitored by the investment team and rebalanced back towards target, or in line with our views on opportunities and risks.

See below for the Growth (MySuper) investment option allocation:

Figures are subject to rounding. Actual asset allocation is current as at 31 March 2025. Asset classes are the building blocks of our investment options. We allocate different proportions to each asset class with the aim of meeting each option’s investment risk and return objective. By investing across a range of asset types, the risk of loss is reduced through diversification. For more information see asset classes.

We periodically review our investment strategy and believe that the Growth (MySuper) option is well positioned for growth over the medium to long term, while maintaining some defensive exposure. Cbus’ Pre-mixed investment options are broadly diversified across asset classes.

Disclosure

The information is about Cbus. It doesn’t take into account your specific needs, so you should look to your own financial position, objectives and requirements before making any financial decisions. Read the Cbus Product Disclosure Statement and the Target Market Determination to decide whether Cbus is right for you, or contact us for a copy.

Other articles you may like

EOFY June 24 Investment update

With Cbus Super celebrating its 40th anniversary this year, we are pleased to reflect on the strong long term investment outcomes we have generated for our members.

Understanding investment basics

The investment decisions you make today can make a big difference to the amount of super you retire with.

Strategic Asset Allocation update

At Cbus, we offer a range of investment options to suit our members goals, time frames and their preferred levels of risk and we invest across a wide range of asset classes including shares.