Cbus Super delivers a strong 10.29%* return

3 July 2025

MEDIA RELEASE

Cbus Super’s Growth (MySuper) investment option has delivered a 10.29%* return for members in a financial year that saw periods of wild swings for investment markets.

The High Growth investment option, which accounts for nearly ten percent† of Cbus’ accumulation members and is skewed towards younger members, returned 11.80%*, while the Index Diversified investment option returned 11.68%*.

Cbus Super’s Chief Investment Officer Leigh Gavin said the strong result, in the year the Fund also reached $100 billion in Funds Under Management, showed the importance of members taking a long-term outlook.

Early indications show that Cbus Super will likely remain one of the top five performing super funds over 10, 15 and 20 year periods‡. Cbus’s Growth (MySuper) investment option has achieved an average annual return over 10 years of 7.75%*.

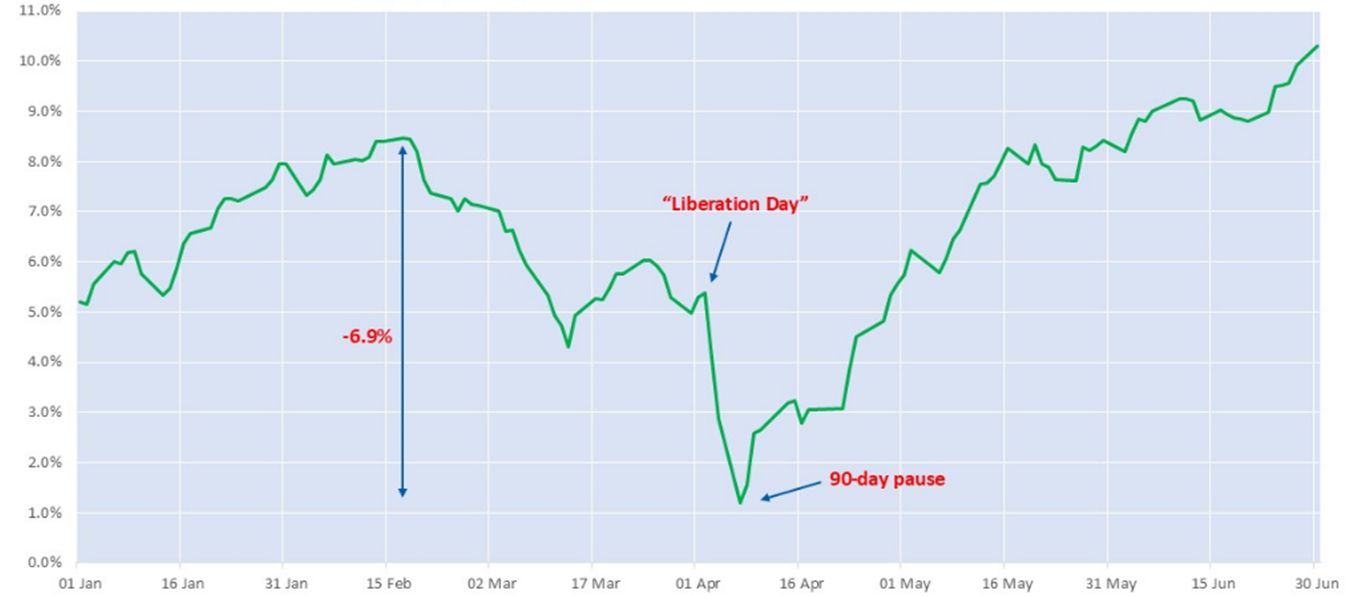

“Underneath the strong numbers is a white-knuckle story of periods of wild volatility,” Mr Gavin said.

“Following Liberation Day, we were looking at returns of 1.20% for the financial year-to-date. Our diversified portfolio and internal investment teams positioned us well to withstand the year’s volatility and achieved an incredible outcome for members.”

“It’s another very strong year for equities both domestically and globally.

“We have also seen strong returns in infrastructure and private credit, as well as the commencement of a rebound in property.”

The strong investment returns come as the Super Guarantee reaches its 12% goal, a change that will mean members will save more for retirement. New modelling by Cbus Super shows a 21-year-old member is projected to have around $25,000 extra in their balance when they reach retirement age thanks to the final Superannuation Guarantee rise to 12 per cent§.

Mr Gavin said Cbus anticipates investment market volatility will continue over the coming months.

“US tariff policy and global instability continue to be major themes for investors,” he said. “The range of possible returns in the US has never been wider. That doesn’t necessarily mean lower returns, but it does likely mean a wider range of plausible outcomes.”

“As the events of FY25 have demonstrated, in your accumulation phase it’s about ‘time in’ the market rather than ‘timing the market’. Even members nearing retirement in April, who stuck with their long-term goals, have ended the financial year with a solid result.”

Cbus slightly reduced US exposure

Cbus slightly reduced its US equities in 2024 largely on valuation grounds, “We entered 2025 underweight US and overweight Europe, which benefited members,” Mr Gavin said.

“Despite short-term risks, we remain optimistic about the US as a long-term investment destination.”

“Investing in the US is more challenging now, but it’s still the world’s most innovative economy, with some of the world’s best companies and an unmatched ability to turn GDP growth into earnings growth, which is ultimately what drives members’ returns.”

The AI transformation

Mr Gavin said on his forward outlook, while geopolitical events will impact markets in the short-term, AI could reshape economies.

“AI is going to impact all of our portfolio and the companies within it.”

“In a decade’s time AI will have changed our economy. We are doing lots of deep thinking on how markets will change, who benefits and how we can be in a position to capitalise on the change,” he said.

Property showing good signs of the bounce back

Mr Gavin said Cbus’s laser-like focus on quality and sustainability has aided the property portfolio to rebound, while the Fund still has some dry powder to pounce on future residential, commercial and industrial opportunities; and will continue to look to recycle capital as assets mature, to invest in newer assets with higher potential returns.

“Our half-interest in two shopping centres, Pacific Fair on the Gold Coast and Sydney’s Macquarie Centre, had fantastic years; both were bought by Cbus Property in the Covid-era retail slump and are now being flooded with shoppers.”

“Improvements were apparent in the overall conditions within the property market over the financial year. We are uniquely placed to benefit and take advantage of opportunities.”

“We also continue to look for ways to recycle capital across the other private market asset classes. In particular, on the infrastructure side, we successfully exited our Bright Energy renewable platform, which produced great long-term returns for our members, and are re-deploying that capital into new assets on behalf of our members.”

Media enquiries: media@cbussuper.com.au or +61 3 9100 4930

Cbus Growth (MySuper) over 2025

Period from 1 Jan 25 - 30 Jun 25. Returns shown are based on the crediting rating for the Growth (MySuper) investment option. The crediting rate is based on returned minus investment fees, taxes, and until 31 January 2020, the percentage based administration fee. Excludes fees and costs that are deducted directly from members' accounts. Past performance is not a reliable indicator of future performance.

* The Growth (MySuper) is the default investment option for accumulation members. As at 30 June 2025. The crediting rate is based on returns minus investment fees and costs, transaction costs and investment-related taxes and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs that are deducted directly from members’ accounts. Past performance is not a reliable indicator of future performance.

† 9.3% of members as at 31 May 2025.

‡ For the period ending 31 May 2025. SuperRatings is a rating agency that collects information from super funds to enable performance comparisons - visit www.superratings.com.au for details of its rating criteria. Please note that SuperRatings, will not release their 30 June results until later in July.

§ This is a projection for illustrative purposes assuming a 21-year-old worker with an $11,500 balance (starting balance based on average Cbus balance for members under age 25 as at 18/06/2025), earning $80,000 + 12% SG a year, works until age of 67 compared to the same worker receiving 11.5% SG a year. Returns in the projection are in today’s dollars and adjusted for inflation of 2.5% p.a. and a further 1.2% p.a. rise in living standards. We make a default insurance premium assumption that $214 will be charged and deducted in future years until retirement and will increase with inflation each year. Results are shown at 1 July upon reaching age 67. The results shown are estimates only and are not guaranteed and should not be relied upon as a true representation of any actual superannuation contributions, retirement benefit or taxation as tax and other rules can change. The 5.75% per annum investment return used in the calculation, is based on the Growth (MySuper) investment objective of CPI + 3.25% p.a., assuming CPI of 2.5% p.a. The return is after investment fees and taxes and excludes fees and costs that are deducted directly from members’ accounts. It is not a guaranteed rate of return. Current administration fees and costs of $52 per year, plus 0.19% of the account balance per year have also been assumed in the calculation. Figures are correct as at 18 June 2025.

This information is about Cbus Super. It doesn’t account for your specific needs. Please consider your financial position, objectives and requirements before making financial decisions. Read the relevant Product Disclosure Statement (PDS) and Target Market Determination to decide if Cbus Super is right for you. Call 1300 361 784 or visit cbussuper.com.au.

Cbus is the leading Industry Super Fund representing those that help build, maintain and shape Australia. As one of Australia’s largest super funds, we provide superannuation and income stream accounts to more than 900,000 members (as at 31 December 2024) and we manage $100 billion of our members’ money (as at 31 December 2024). Our members include workers and retirees, their families and employers. As of April 2022, Cbus merged with Media Super and offers Media Super products. In May 2023 Cbus Super successfully completed its merger with EISS Super, welcoming 17,000 new members and establishing itself as the leading fund for energy and electrical workers in Australia.

Issued 3 July 2025, United Super Pty Ltd ABN 46 006 261 623 AFSL 233792 as Trustee for Construction and Building Unions Superannuation Fund (Cbus and/or Cbus Super) ABN 75 493 363 262.