The potential long-term impacts of switching investment options

Investment markets such as the Australian share market and other global investment markets have experienced large relative fluctuations in value since the beginning of 2020. These fluctuations can be attributed to continued market uncertainty resulting from a variety of issues.

Why Cash can also be a risky investment

While an investment in our Cash investment option might feel safe, did you know it could also put your retirement goals at risk?

We know it’s hard to escape the latest news headlines. We’re given daily reminders about higher interest rates, inflation uncertainty and the ongoing conflict in the Middle East. It’s understandable if you feel anxious about your super account balance. After all, it’s your savings for your retirement.

Despite its low likelihood to deliver members a negative return in any one single year, its returns over the long term are expected to be lower than any of our other options. These missed potential returns could add up over time.

What impact could investing in the Cash investment option have on my retirement?

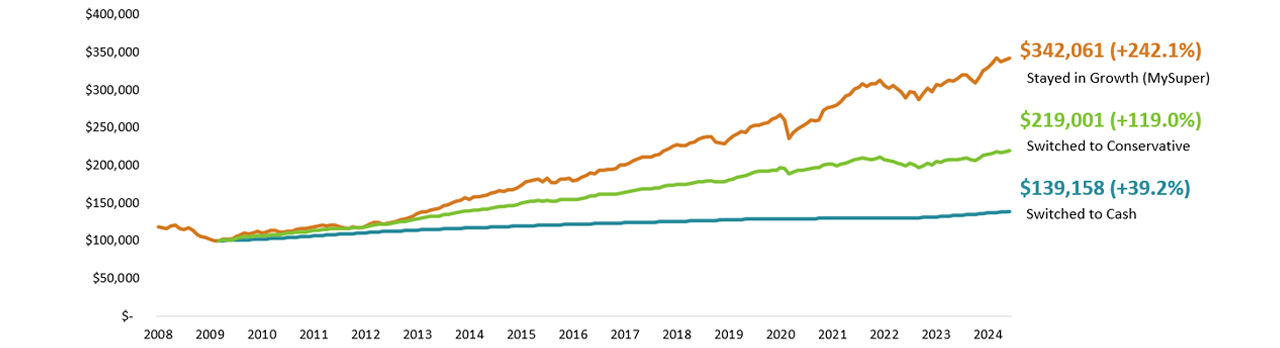

To illustrate, here are three members who made different investment choices during the Global Financial Crisis:

- One member stayed in the Growth (MySuper) investment option

- One member switched to our Conservative investment option

- One member switched to our Cash investment option

First invested in the Growth (MySuper) option - switched with $100,000 balance during the Global Financial Crisis*

Calculations are based on historical crediting rates from 30 June 2008 to 30 June 2024, switching on 31 March 2009 with a super account balance of $100,000. The Cash return reflects the historical crediting rates of the Cash investment option from 1 April 2009. Prior to this date, the historical performance of the Capital Guaranteed Option has been used for illustration purposes. Past performance is not a reliable indicator of future performance.

* These figures are for illustration purposes only and are based on the crediting rate, which is the return minus investment fees, taxes, and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs deducted directly from members’ accounts.

As you can see, the member who stayed in the Growth (MySuper) investment option would have been over $200,000 better off than the member who switched into the Cash investment option as at 30 June this year. That's also despite more recent market volatility caused by the pandemic and geopolitical conflicts in both the Ukraine and the Middle East.

This is why when you are looking at the investment option your super is invested in, it’s important to consider your investment time frame and the potential future impacts of making any changes.

What if I am in or approaching retirement?

Investing in the Cash investment option may feel like the right decision if you’re close to or already in retirement but remember, even if you’ve stopped working, your savings could be invested for at least another 20 years!

This means you still have the potential to benefit from a lot of investment return growth. Super is a long-term investment, and most members have time to ride out short term market volatility.

What do I need to consider before switching to a less risky investment option like ‘Cash’?

Periods of negative returns are expected to occur from time to time and are a completely normal part of financial markets. We invest your super across a wide range of asset types, and our portfolios are well diversified and designed to meet their investment objectives over the long-term.

If you’re still worried about your super and thinking of changing your investment option, particularly to a more conservative option, you should consider the following:

- What is your investment timeframe and what could be the future impact of changing investment options, particularly in response to short-term market ups and downs?

- Changing to lower risk investment options or making frequent switches can, over the longer term, leave you with lower retirement savings.

- In addition to missing out on future growth through investment earnings, there is the risk of not benefiting from rises in investment markets following a fall.

Choosing an investment option that doesn’t take your long-term goals into account - even for just a short period of time - could end up costing you in retirement.

This information is general in nature. It does not take into account your specific needs. You should look at your own financial position, objectives and requirements before making financial decisions. Read the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) to decide which product is right for you. For more information on Cbus investments view cbussuper.com.au/investments.

Where can I go if I have more questions?

Member Advice Services

Our Advice team can help you understand your options and offer different levels of guidance depending on what you need.

Our market volatility hub

We understand that market ups and downs can be unsettling however it is important to remember that super is a long-term investment and our portfolios are well diversified and designed to withstand them.