Retirement

The Age Pension

When you receive retirement income from your super, you may still be eligible for the government Age Pension.

Read more...JobSeeker Payment

The JobSeeker Payment is financial help if you're between 22 and 67 and looking for work. It's also for when you're sick or injured and can't do your usual work for a short time. To get the JobSeeker Payment, you need to meet certain criteria, including income and assets tests.

Disability Support Pension

The Disability Support Pension is financial help if you have a physical, intellectual or psychiatric condition that's likely to last for more than 2 years, which stops you from working. There are criteria you need to meet if you claim this benefit.

Home Equity Access Scheme

The Home Equity Access Scheme (HEAS) lets Australians aged 67 or older receive non-taxable loan payments or a lump sum from Centrelink, using their Australian real estate as security.

A no negative equity guarantee applies, meaning you'll never owe Centrelink more than the value of the property secured against the loan.

The HEAS is available to those who qualify for the Age Pension or meet the qualifying rules but don't get any Age Pension, because their income or assets are over the thresholds. It can provide up to $67,000 per year for a couple, minus any Age Pension payments already being received.

You and your partner may be able to use the scheme in combination with other sources of retirement income.

Commonwealth Seniors Health Card

A Commonwealth Seniors Health Card is a concession card to get cheaper health care and some discounts if you are 67 or older and not receiving any Age Pension.

To get this card you need to meet some conditions, including an income test.

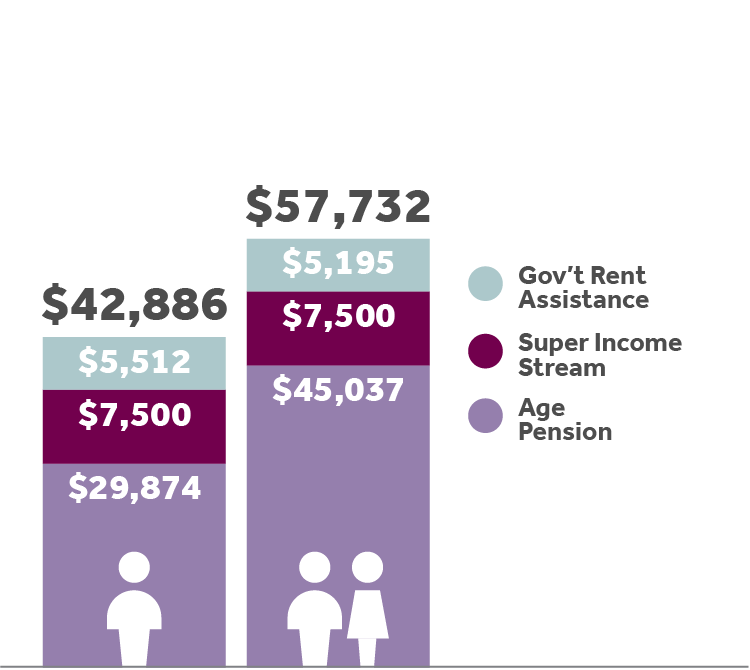

For a single person or a couple who are renting, you may be able to make up your income from a combination of:

Annual retirement income from 67:*

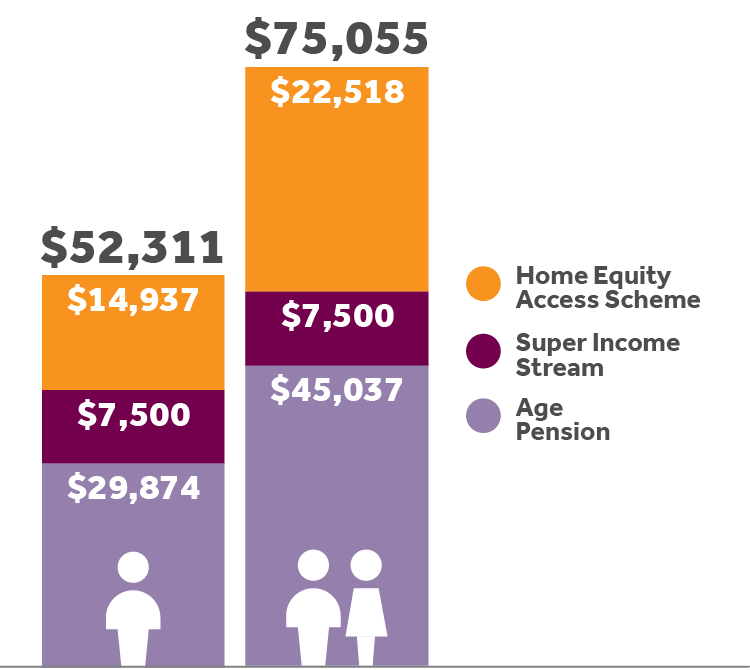

For a single person or a couple who own a home, you may be able to make up your income from a combination of:

Annual retirement income from 67:*

*Assumptions: