Retirement

Fully Retired Super Income Stream

A Fully Retired account gives a regular, flexible, tax-effective income for people over 60 who have retired, or anyone over 65.

Read more...If you’re approaching retirement, you can use a TTR account to access your super. You can reduce the hours you’re working and use a TTR account to top up your take-home pay. Or, you can use it to save more for retirement.

Watch the video.

Read the transcript

You've worked hard for your super.

And now that you're in your last few years of work, we're here to help you make the most of it.

You're more familiar with the build-up phase of your super where money is regularly added to your fund and invested to increase your savings.

But the catch is that you can't access it without exceptional circumstances.

Transition to retirement is the time between the build-up and the retirement phase of super.

Based on your circumstances, it can help achieve various objectives.

One of those is providing an additional income.

Maybe you want to cut back on your work hours, or knock over your household debt before retiring.

That's where TTR can help.

Keep in mind that doing so may reduce your super.

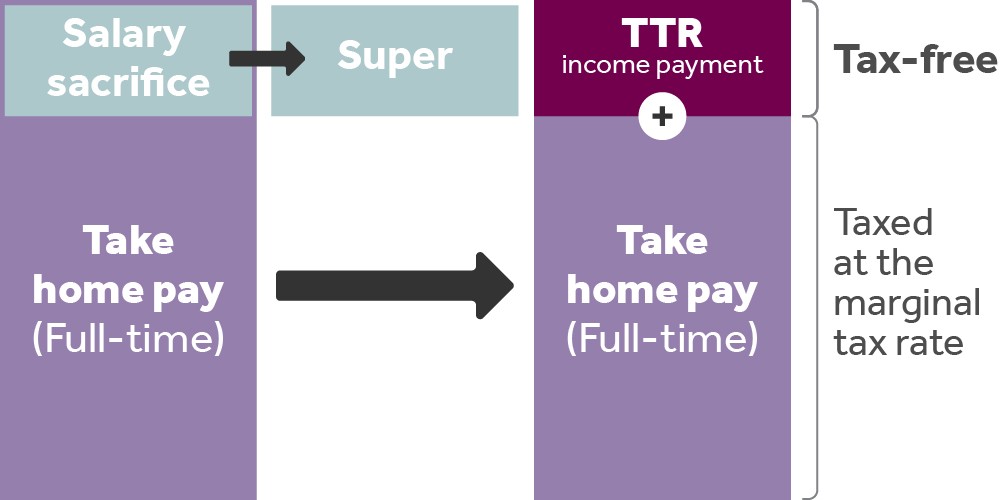

But TTR can also help boost your super by letting you contribute more of your wage to your retirement savings, while allowing you to withdraw some of it as income.

It's often taxed lower than your regular income, offering potential tax advantages.

While TTR can be complicated it, can produce excellent outcomes.

It's worth exploring to see if it's a good fit for you.

We get that it might be challenging to understand, but we're here to help.

Cbus offers dedicated seminars explaining how TTR works and who it's suitable for.

Once you've learned more about TTR and determined it's right for you, the next step is to contact Advice services on 1300 361 784.

We provide personalised advice for eligible members at no additional cost.

Cbus, making hard work pay off.

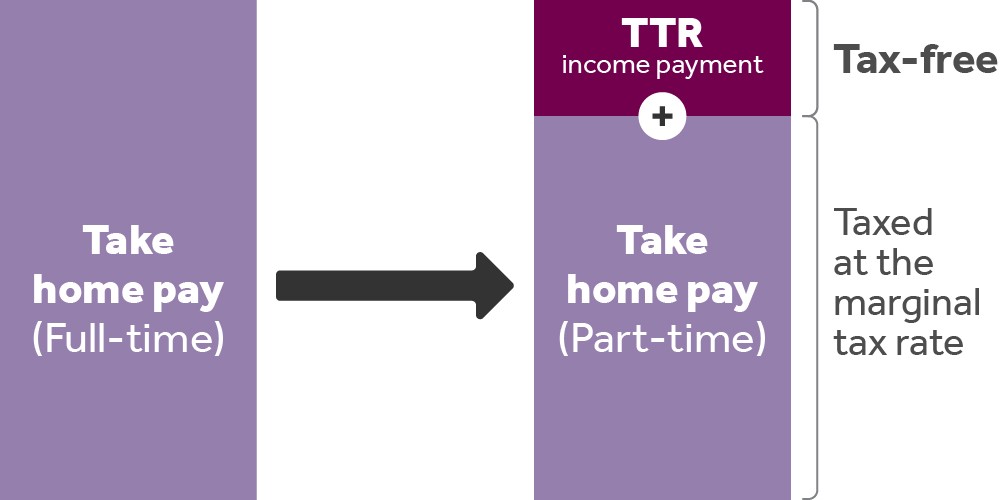

Reduce your work hours and top up your take home pay from your super.

Income payments are tax-free.

Investment earnings are only taxed up to 15%, not your marginal tax rate.

Draw down between 4% - 10% of your balance as income each year.

Choose from a range of investment options to keep your super working hard.

Keep your accumulation super account open and keep your insurance.

When you open your account, decide how much you want to get as a regular payment and how often.

You can change the amount and timing of payments at any time. Your new payment amount needs to be within the government limits.

Regular payments are sent to your chosen bank account.

The rest of your balance stays invested, less fees, income payments, withdrawals and tax (if applicable).

Your account will convert to a Fully Retired Super Income Stream when you:

You won't pay tax on investment earnings.

You may qualify for an Income stream tax refund.

You’ll get payments until the money in your account runs out.

When you die, any remaining balance of your account may be paid to your beneficiaries as a cash payment or regular income.

Bill is 60 and has $150,000 in super. He earns $75,000 a year (before tax), and his take-home pay is $2,374 a fortnight.

Bill wants to cut back his hours to four days a week, but not reduce his take-home pay. Bill speaks to a Cbus finanical adviser who lets him know he can:

Bill can enjoy his extra day off, without changing his spending habits.*

Note: By using super now, Bill is likely to have less for when he fully retires.

Mary is also 60. She earns $75,000 a year (before tax) and has $150,000 in super.

Mary wants to retire at 67. With only a few years to go, she wants to do what she can to boost her super. Mary’s Cbus financial adviser lets her know she can:

This means Mary can add an extra $3,150 to her super account over the year without affecting her take-home pay.*

*These examples are provided for illustration purposes only and are not intended to replace financial advice. This information doesn’t represent the benefits that you could receive or the fees and costs you may pay - the outcome will depend on your personal circumstances.

Assumptions: Calculators are based on 2025/2026 tax rates and the Medicare levy of up to 2% of taxable income is not included. Rebates or tax offsets that may lower the tax you pay are also not included.

What is the transfer balance cap? Does it apply to TTR accounts?

The TTR account does not count towards your personal transfer balance cap. This is because investment earnings in TTR accounts are taxed.

The government has limited the amount of super you can transfer into tax-free retirement accounts (like the Fully Retired account) to $2 million, if you're starting your first retirement income stream account in or after the 2025/26 financial year.

This is called the transfer balance cap. The cap is a lifetime limit on how much you can put into tax-free retirement accounts, pensions and annuities, with Cbus and any other super funds.

Are you planning to claim a tax deduction?

To claim a tax deduction for personal contributions to super, you need to do this before you transfer any money out of your super account.

Please note that:

To claim a tax deduction:

Before you open a TTR account, make sure you understand all about it. Here's what you'll need to be across:

The rules and conditions around the TTR account are complex. Especially around tax.

Our financial advisers can help you make confident choices about retirement.

Our calculators can help you undertand how to maximise your super and plan for retirement.

Our in-person seminars and online webinars can help you get the most out of your super and plan for retirement.

Who’s eligible for a TTR account?

To be eligible to open a TTR account, you need to be 60 - 64.

Are there any restrictions on a TTR account?

Once you turn 65 (or tell us you meet another condition of release that gives you unrestricted access to your TTR account balance) your account will convert to a Fully Retired Super Income Stream.

As part of this:

How often can you receive income stream payments?

You can choose to have your income payments paid:

| Frequency | Payment date |

|---|---|

| Fortnightly (default) | Every second Friday |

| Monthly, quarterly, half-yearly, yearly | 15th or 28th of the month |

You can’t choose an annual payment date of 15 July because your 1 July account balance isn’t available at that date. If you don’t choose a frequency, you’ll be paid fortnightly. You’ll get payments until the money in your account runs out.

How are investment earning taxed?

In a TTR account, your investment earnings are taxed at up to 15%.

Can more money be added to a TTR account?

Once you’ve opened a TTR account, you can’t add any more money to it. If you’d like to add more, you’ll need to open a new TTR account.

Can lump sum withdrawals be made from a TTR account?

Can a TTR account be converted to a Fully Retired account?

When you reach 65, your TTR account will automatically become a Fully Retired account.

A Fully Retired account works in much the same way as a TTR account, but you don’t have to pay tax on your investment earnings. You can also make make withdrawals more easily.

We’ll also change your TTR account to a Fully Retired account if you tell us that you’ve met one of the following conditions of release:

If you convert your TTR account into a Fully Retired account, the transferred balance will count towards your personal transfer balance cap.

Read more in the TTR account Product Disclosure Statement (PDF).